Grow Grand Island Area Partnership Logo, Courtesy

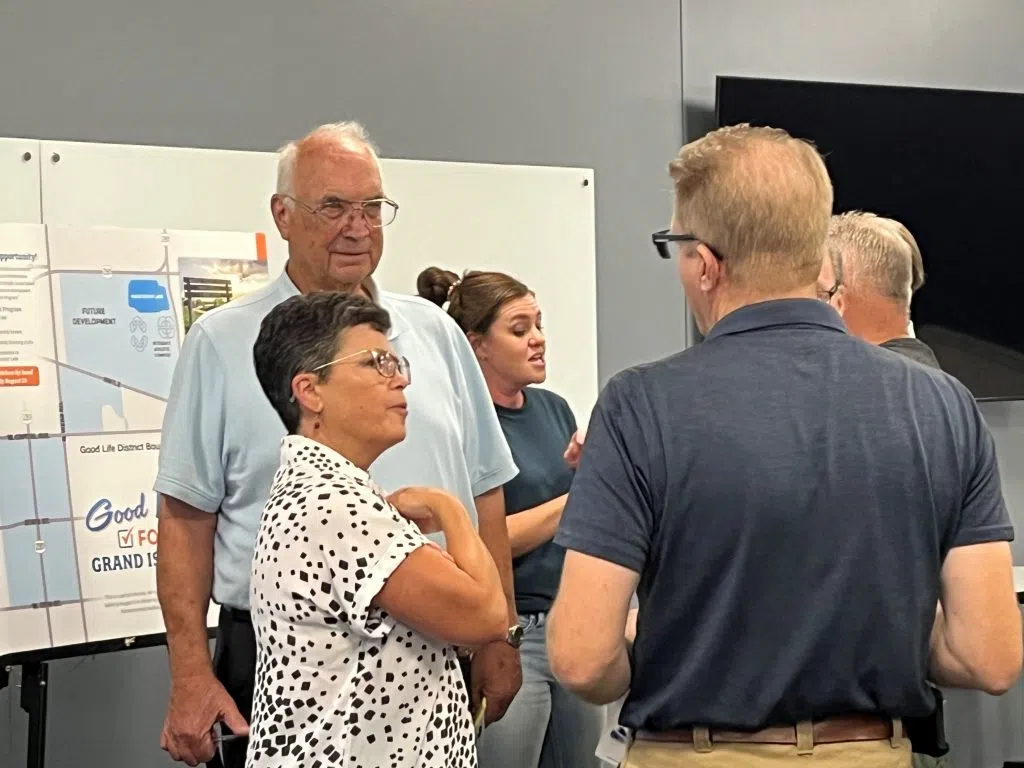

GRAND ISLAND — Approximately 30 people were present at the start of a two-hour informational session late Wednesday afternoon, July 31, at the Greater Grand Island Community Foundation’s meeting room concerning the special election ballot for the city’s newly approved Good Life District.

Grand Island residents have the opportunity to submit ballots by mail until Aug. 13 concerning whether the city should be authorized to establish a Good Life Economic Development Program within the approved Good Life District.

Hall County Election Commissioner said July 31 that a standard first-class stamp can be affixed to the ballot envelope if it is returned by mail. Overstreet does not recommend mailing the ballot after Saturday. The ballot must be received by 5 p.m. Aug. 13. There is a drop-off ballot box on the east side of the Hall County Administration Building, 121 S. Pine St.

Grow Grand Island sponsored the July 31 meeting. Grow Grand Island Chairperson Tonja Brown said she sees the Good Life District as a quality of life issue and a way to attract young families to Grand Island. She also said the Good Life District will generate more tourism, which will result in more tax revenue.

She said the most common questions she was receiving July 31 regarded TIF.

“This is an alternative program” to TIF, she said.

The Good Life District is being promoted through a variety of methods including billboards, social media, presentations to small groups, and personal conversations. A website for the issue is www.goodlifegi.org.

Brown, Grand Island City Administrator Laura McAloon, and Grand Island Convention and Visitors Bureau Executive Director Brad Mellema were among people on hand to answer questions about the initiative. A handout titled “City of Grand Island, Good Life District, Q & A” was distributed at the event.

The program would allow the city to recapture the state’s 2.75 percent foregone sales tax and use that revenue for the Good Life District.

Grand Island’s City Council voted in mid-June to have a special election concerning the Good Life District.

Woodsonia Real Estate of Elkhorn submitted an application to the Nebraska Department of Economic Development for the project. With the formation of the Good Life District, the Nebraska Department of Revenue will reduce the state sales tax rate within the Good Life District from 5.5 percent to 2.75 percent. The state sales tax reduction will go into effect on Oct. 1.

According to a question-and-answer section on the City’s website, the Good Life District is approximately 875 acres in northwest Grand Island, generally including the properties bordering Highway 281 from 13th Street to West Capital Avenue, and the “undeveloped area northeast of North Webb Road and West Capital Avenue extending to and including the existing Veteran’s Athletic Complex.” The Good Life District does not include the former Nebraska Veterans Home property or the Veterans Club.

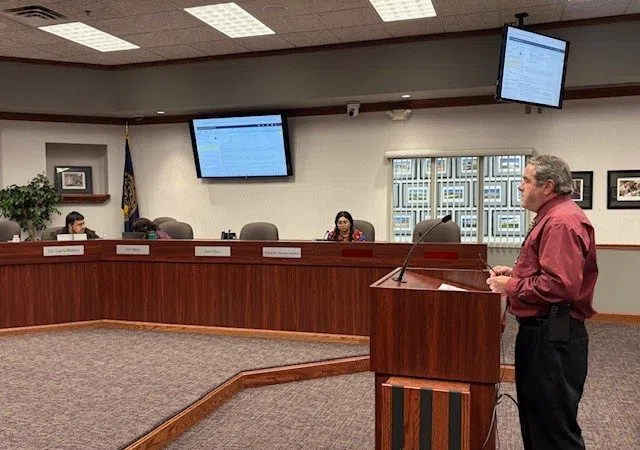

At the June City Council meeting, Gerald Poels of Grand Island addressed the City Council.

“You know that these special elections are not well-attended,” Poels said. He said he would prefer seeing the matter included in the November general election. “It is a maneuver being done to insure that it passes.”

In early June, Kate Ellingson, marketing and public relations director for the Nebraska Department of Economic Development, said that Woodsonia is making an estimated $550 million investment in the project, and estimated that 5,000 new jobs would be created.

The Department of Revenue has told the city that 2023 net taxable sales within the approved Grand Island Good Life District was $286,737,879. Based on that information, if the Good Life District existed in 2023, the city could have recaptured 2.75 percent or $7,885,292 from existing retail sales in the recently approved boundaries. A Good Life District exists for 30 years.

According to the city’s website, “based on publicly available information and news reports, the City understands there is development under consideration which will include retail, indoor and outdoor sports and other recreational facilities, office and residential uses, and more within Grand Island’s Good Life District.”

On the question-and-answer sheet distributed July 31, one question was whether the initiative would negatively impact Grand Island Public Schools and its funding.

“There is nothing in the Good Life District statutes that impacts the school district or school district funding. The school district might be impacted by tax increment financing if it is approved in the future for a project within the Good Life District, but that is always the case and not unique to the Good Life District,” the Q-and-A sheet said.

It was also asked who benefits from the Good Life District Economic Development Program.

“Benefits from the program…will not be limited to any one developer or property owner in the Good Life District. Every property owner and developer in the Good Life District…will be able to apply for benefits from the program. Also, the City will be able to utilize funding in the program for public infrastructure costs in and related to the Good Life District,” the handout said.

Another question on the handout is whether property owners in the Good Life District still control their own property.

“Any property owner not wishing to take advantage of the program incentives is free to develop (or not develop their property without regard to the Good Life District, subject to the City’s zoning rules and other similar restrictions which the City has had for years before the establishment of a Good Life District.”

No property taxes are permitted to be levied for the program, and the City is not permitted to appropriate any property taxes to the Program, the handout said. Also, the City is not permitted to appropriate any local option sales tax collected outside the Good Life District to the program.

The handout addresses the question, “What happens if voters don’t approve the program?”

“If it doesn’t pass, the City’s existing tools are less effective than the proposed program. Development in the Good Life District would likely continue, but possibly with scaled down development and lower tax revenues for the City to utilize in the future.”

According to the website goodlifegi.org, the area will include projects such as a large indoor sports complex, a multi-sport all-turf outdoor complex, a commercial/business park, single family homes, multifamily housing units, and enhancements to Eagle Scout Lake.

Plans are underway to build a 200,000-square-foot sports facility featuring a 35,000-square-foot field house, a sports/agility training area, indoor pickleball courts, 16 volleyball courts, eight basketball courts, an indoor elevated walking/running track, elevated tournament viewing, meeting rooms, and concessions.

Information about the initiative is posted on the “Grow Grand Island” Facebook page.

Grand Island City Administrator Laura McAloon answers questions at an informational session July 31 about the Good Life District program, (Carol Bryant, Central Nebraska Today)