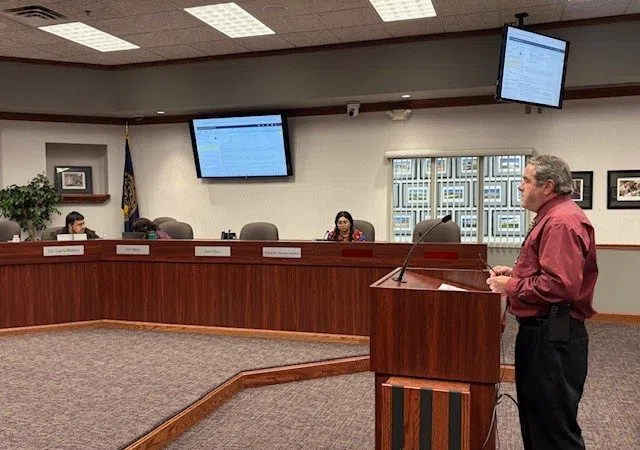

Grand Island City Hall, (Brian Neben, Central Nebraska Today)

GRAND ISLAND – The Grand Island City Council had public hearings Sept 3 on three budget and tax topics. No one from the public appeared at any of the three hearings to speak.

The hearings concerned the annual city budget and annual appropriations bill; general property and Community Redevelopment Authority tax request; and Parking District No. 2 (Ramp) tax request.

Patrick Brown, the city’s chief financial officer and assistant city administrator, provided information concerning how much property tax that a property owner would pay in 2025 compared to 2024.

For 2024, the total general property tax levy was 0.293146. According to Chief Financial Officer Patrick Brown, the owner of a $100,000 home would pay $293.15 in property tax. In 2025, the mill levy will be 0.278135. The owner of a $100,000 home would pay $278.14 in property tax.

Mayor Roger Steele noted that the city has kept the same property tax asking for the last six years.

“It’s a feather in the cap for the city,” Steele said.

The city’s FY 2025 property tax request is $12,207,540. The tax request for the Community Redevelopment Authority is $798,990 for a total request of $13,006,530.