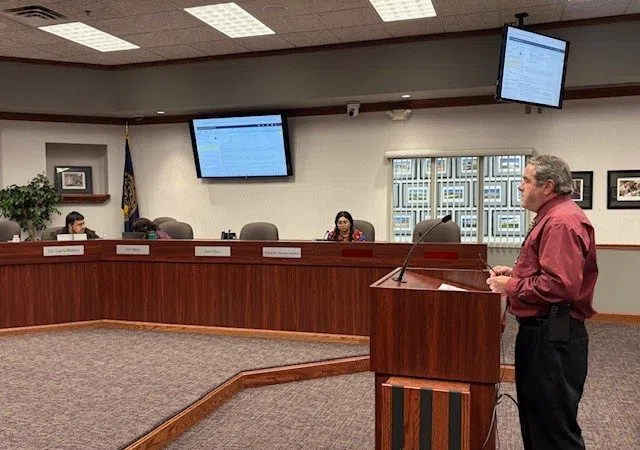

GRAND ISLAND — Doniphan resident John Amick led a discussion with the Hall County Board of Commissioners on Tuesday, Feb. 13, concerning LB 1067, which seeks to reduce and eliminate Nebraska’s inheritance tax.

The Legislature’s Revenue Committee held a hearing on LB 1067 on Thursday, Feb. 8. Amick testified at the hearing.

In a memo to Commissioners, Amick wrote, ‘Proponents of the bill, including me, testified how the current structure discriminates against heirs unrelated to decedents who leave them property (15 percent tax), how it is an inconsistent revenue source for county governments, and how Nebraska is one of only five states that have not eliminated the inheritance tax.”

Amick noted that opponents of LB 1067 are mostly county officials and the Nebraska Association of County Officials (NACO). They are concerned that elimination of the tax would create county budget shortfalls and cause them to raise property taxes.

Amick provided information from the Hall County Treasurer’s Office about Nebraska inheritance tax collected in Hall County from 2019 to 2023:

- *2019, $1,576,511

- *2020, $2,238,951

- *2021, $2,275,754

- *2022, $2,197,181

- *2023, $1,486,245

One suggestion Amick had is increasing the Documentary Stamp Tax from $2.25 to $2.75. Currently, when real estate property is sold or transferred, the seller pays the county Register of Deeds $2.25 per every $1,000 of the sale price of the property. Amick gave statistics on how much Hall County collected in Documentary Stamp Tax from 2019 through 2023, with data provided by the Register of Deeds office.

Amick said he would like to see Commissioners vote to see which members support LB 1067.

Board Chairman Ron Peterson said, “If they don’t replace the revenue, we can’t support it.”